Home » FCRI Update

FCRI Update

February 15, 2021

This Month’s FCRI, a Stock Index of 8 Publicly Traded Clinical Trials Companies

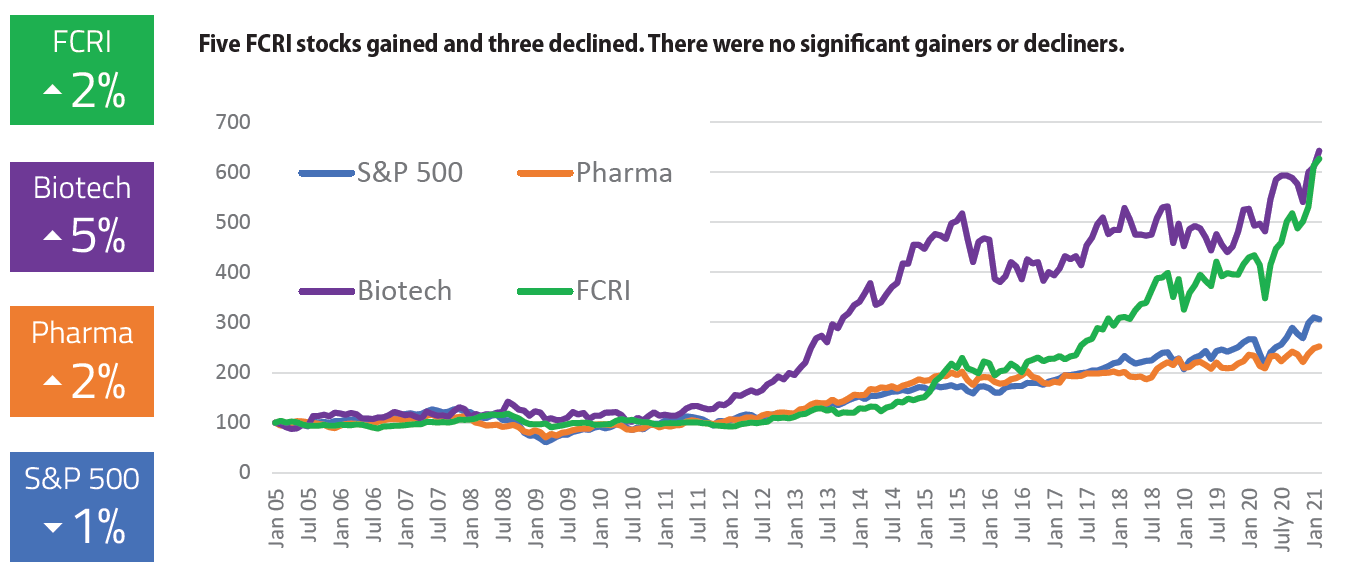

Here is this month’s First Clinical Research Index (FCRI), a stock index of 8 publicly traded clinical research companies. Each month, CenterWatch Weekly will publish the calculation of the FCRI, based on the closing stock prices on the last trading day of the prior month, to show how the industry’s publicly traded stocks are faring compared to three other widely followed indices: the Standard & Poor’s (S&P) 500 index, the S&P Pharmaceutical Index and the S&P Biopharmaceutical Index. For more information about the index, read on.

Notes on Indices

First Clinical Research Index (FCRI). Calculated as the mean average percentage change from baseline, dividends excluded, adjusted for stock splits. In other words, the indices are not weighted for stock price or market capitalization. Prices are in local currencies. Index components may change from time to time based on new listings, mergers and other factors. Components include 8 publicly traded clinical research stocks: CMIC (2309:JP), EPS (4282:JP), Hangzhou Tigermed Consulting (300347:CH), ICON (ICLR:US), IQVIA Holdings (IQV:US), Medpace Holdings (MEDP:US), PRA Health Sciences (PRAH:US), and Syneos Health (SYNH:US).

S&P 500 Index (SPX). Capitalization-weighted representative sample of 500 mostly large-capitalization companies in leading industries of the U.S. economy.

S&P 500 Pharmaceutical Index (S5PHARX). Capitalization-weighted S&P 500 companies engaged in research, development or production of pharmaceuticals.

S&P 500 Biotechnology Index (S5BIOTX). Capitalization-weighted S&P 500 companies primarily involved in development, manufacturing or marketing of products based on advanced biotechnology research.

Stock and index prices are available at http://www.bloomberg.com/ and http://www.marketwatch.com.

Upcoming Events

-

21Oct